Benchmark indices erased steep early losses and ended the session higher after positive signals on India–US relations revived investor confidence.

Early sell-off gives way to sudden recovery

Stock markets in India had a very different day on Monday as they first opened at a deep loss and then, miraculously, bounced back, and this happen because of the worries about US tariffs and the continuous selling by foreign institutional investors (FIIs). The bad sentiment, nevertheless, did not last long as the Sensex and Nifty managed to recover very quickly, within an hour of trading.

At the beginning of the session, the Sensex was down by over 700 points, and the Nifty was below the critical level of 25,500 points. But the indices that had been falling for so long turned very quickly and entered the green territory, puzzling all the investors.

US Ambassador’s remarks lift market sentiment

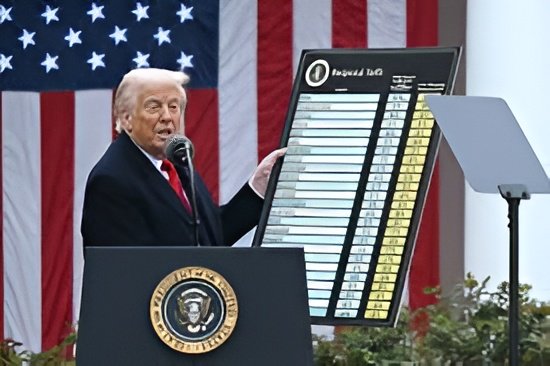

The abrupt reversal was set off by the comments of the new US ambassador to India, Sergio Gore, who took over on Monday. His remarks underlining the magnitude of the India–US relationship brought new hope to the markets.

Sergio Gore characterized India and the US as major strategic partners and acknowledged that the differences of opinions might occur between friends, but the cooperation would remain firm. The investors’ response was favorable after he revealed that the next round of trade discussions would be between the two countries on the 13th of January.

Moreover, his announcement that India has been invited to partake in the US-led PacSilicon alliance, a strategic maneuver to bolster and safeguard the global silicon supply chain, was a further impetus to the bulls. All these factors led the markets to break their five-day losing streak.

Sensex recovers nearly 1,100 points from lows

The positive cues that followed led to the recovery of the Sensex by almost 1,100 points from its intraday low. The index that is considered as a benchmark commenced at 83,435.31, which is lower than its previous closing price of 83,576.24, and dropped to an intraday low of 82,861.07. The recovery allowed the index to rise up to the intraday high of 83,962.33 before it finally settled at 83,878.17, thus, the index went up by 301.93 points.

Nifty, in turn, followed the same pattern as it also went upwards. It first dropped to the lowest intraday point at 25,473.40, then went up to 25,813.15, and finally ended up at 25,790.25, which is an increase of 106.95 points.

Rupee, global cues and sectoral performance

The exchange rate of the rupee stood at 90.16 for one US dollar. The major gainers on the Sensex were Tata Steel, Asian Paints, Trent, SBI, and Hindustan Unilever, which showed the presence of broad-based buying. Conversely, Infosys, Bajaj Finance, BEL, L&T, and HDFC Bank experienced losses at the close of the market.

In the international commodities market, the price of Brent crude was $63.02 a barrel, whilst the price of gold was still at the unprecedented high of $4,589 an ounce, which was a sign of the prevailing uncertainty in the global markets.

Stock market to remain closed on January 15

At the same time, local body elections in Maharashtra will prompt the stock market to be closed on January 15. The leading exchanges BSE and NSE have made it known that trading across the entire gamut of equities, derivatives, commodities, and electronic gold receipts will not be conducted on that day.

The abrupt rebound emphasizes the extreme sensitivity of the market mood to geopolitical and trade-related occurrences, especially those connected to important countries like India and the USA.